For the world, 2020 is a year to forget as quickly as possible. Everyone’s lives were turned upside down. This certainly included the professional pest control industry. Overnight, accepted daily routines disappeared. The first step was to ensure pest control was recognized as an essential service by the U.S. Department of Homeland Security. Fortunately, this status was achieved remarkably quickly, allowing frontline technicians to continue to serve customers.

The next hurdle was to ensure the safety of those frontline workers, so personal protective equipment (PPE) became a priority. Wherever possible, staff began remote working and actions were taken to reduce costs and conserve cash. This included immediately suspending all corporate mergers and acquisitions (M&A) by the top four international pest control companies — namely Rentokil, Rollins (Orkin), ServiceMaster (Terminix) and Anticimex.

Now over a year later, how have things developed? The pest control industry has proven itself an essential service and once again shown its credentials as a highly innovative industry. With lockdown, more customers worked from home, more pests were spotted (both inside and out), so residential requests rose. For commercial customers, especially those operating within the travel, hotel and catering sectors, it was a struggle. Service frequency levels were either reduced or altogether canceled.

However, the need for disinfection services emerged and, without exception, this opportunity was seized by the large companies. Rentokil, for example, launched disinfection services across 60 countries in just four weeks. As a result, the company’s Hygiene sector grew 36.8 percent during the year, accounting for $1,034 million (26 percent) of ongoing (£744m) revenue (see table below). Pest Control, on the other hand, grew only 1 percent to $2,435 million (£1,752m) ongoing revenue, which accounted for 62 percent of the business (64 percent in 2019).

Digital communication — whether between employees and customers or for internal company discussions — became essential for staffers to work remotely. This applied equally to office staff utilizing systems such as Zoom and Microsoft Teams, to technicians who were able to keep a check on pest infestations without even entering the premises via the use of 24/7 rodent remote monitoring and recording systems. Digital engagement with customers became even more important with increased use of websites, webinars and sector-specific marketing campaigns. For example, in 2020, Rentokil sent 2.9 million emails in the UK with an open rate of more than 60 percent.

| Rentokil Global Revenue Breakdown 2019-2020 | ||||

|---|---|---|---|---|

Year | Pest Control | Hygiene (provision and maintenance of products like air fresheners, sanitizers, floor protection mats, etc.) | Protect & Enhance (other route-based services [plants, workwear, property care, etc.]) | Total Revenue ($m USD) |

| 2020 | 62% ($2,435m/£1,752m) | 26% ($1,034m/£744m) | 12% ($486m/£350m) | $3,955 m |

| 2019 | 64% ($2,363m/£1,700m) | 21% ($760m/£547m) | 15% ($553m/£398m) | $3,676 m |

| Source: Rentokil Annual Reports | ||||

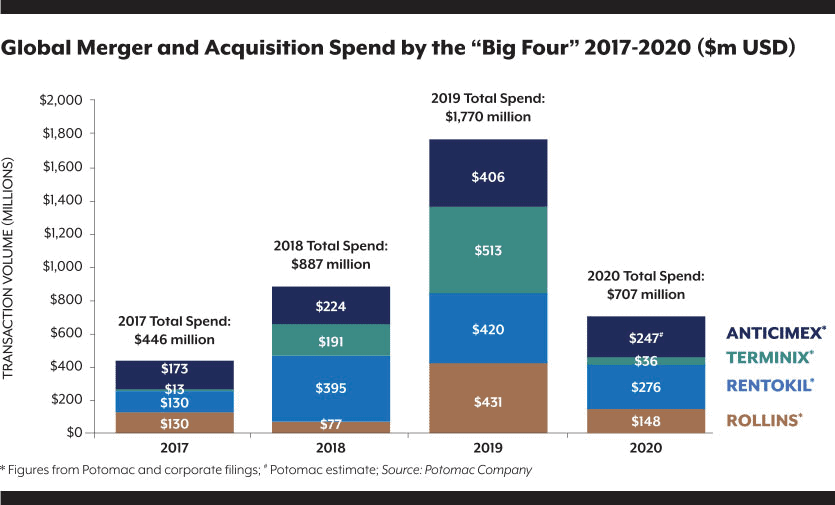

WHAT HAPPENED IN M&A? It’s no secret the long-term goal of the four largest worldwide pest control companies is to grow — and grow a lot. This growth either can be organically, via expansion of services they already provide, or by acquiring other companies (M&A). For Rentokil, Rollins, ServiceMaster and Anticimex, a.k.a. the “big four,” the M&A route has provided not only a speedy means to grow but also a profitable one. It also offers them a means of entering, or strengthening their presence in, new geographic areas. Running in parallel, and supporting acquisition activity, is an equity market that views stock in this sector as safe and dependable.

Up until 2019, the level of spend on company acquisitions by the “big four” has steadily grown, reaching a peak of nearly $1.8 billion in 2019. Of the “big four,” acquisition spend globally by both Rentokil and Anticimex has been remarkably similar over the four years 2017-20.

It’s a similar spend by Rollins and Terminix. The high level of spend by Rollins in 2019 is accounted for by virtually one acquisition alone — that of California-based Clark Pest Control in April 2019 for $395.3 million. Clark was the 9th largest company in the 2019 PCT Top 100 rankings, making it the biggest Rollins acquisition since the company acquired HomeTeam Pest Defense in 2008.

Had the pandemic not arrived, the volume of acquisitions in 2020 was predicted to exceed that of 2019. But with the arrival of COVID and the economic uncertainty, M&A activity ceased virtually overnight.

“2020 started as a strong year for M&A, then the pandemic hit, which brought the market to a standstill…deals on the cusp of being finalized were simply abandoned. But by Q4 2020 the market returned, as purchasers tried to catch up on lost ground and multiples eclipsed their 2019 high. Over a half billion dollars worth of deals were finalized in the last 100 days of 2020, including five from the PCT Top 100,” explained Paul Giannamore, managing director of M&A at the Potomac Company.

“In March of 2020, I thought the jig was up and this consolidation bubble had finally burst. But in spectacular fashion, the coronavirus pandemic elicited an unimaginable fiscal and monetary response from governments, which has further propped up asset prices. Potomac has the largest sell-side M&A pipeline we’ve ever had and I won’t be surprised to see over $2 billion in global pest control transaction volume in 2021,” Giannamore said.

Several analysts are forecasting the pest control industry to come out of the pandemic stronger than before. It is an attractive, non-cyclical market worth $21 billion and estimated to grow at an expected average compound annual growth rate (CAGR) of 5.2 percent per annum to 2025 (source: Allied Research Consultants).

The North American market (United States, Canada and Mexico) accounts for roughly 60 percent of the global servicing market so it is prime territory for growth via M&A. Rich Kalik, a partner with Specialty Consultants, explained: “In 2020 the U.S. structural pest control industry generated an estimated $9.627 billion in total service revenue, a 2.9 percent increase from the $9.359 billion measured in 2019. Achieving nearly 3 percent revenue growth when total U.S. GDP declined 3.5 percent in 2020 is remarkable and it demonstrates the resilience of the professional pest control industry and its importance as an essential service.”

The balance is made up of Europe (19 percent), Asia (13 percent), the Pacific region (around 4 percent) and the rest of the world (4 percent). China and parts of Southeast Asia might be the most rapidly growing markets with their rising levels of income, but the vast majority of M&A activity is concentrated within the already well-developed markets.

ROLLINS STILL #1. This year’s PCT Top 100 reveals that Rollins (which includes Orkin, HomeTeam Pest Defense, Clark, Western Pest Services and many more) retains its No. 1 spot with revenue up 7.2 percent to $2,161 million with income before tax increasing 35.8 percent to $355 million, as recorded in the company’s 2020 annual report. Organic growth accounted for 3.8 percent of the increase with the balance coming from acquisitions. However, internationally the company’s foreign operations accounted for approximately 7 percent of revenue (8 percent in 2019). (Note: International revenue is not included in the Top 100 which is why Rollins’ total revenue here is slightly higher.)

| Rollins Revenue Breakdown 2019-2020 | ||||

|---|---|---|---|---|

Year | Residential Pest Control | Commercial Pest Control | Termite & Ancillary | Total Revenue |

| 2020 | 45% | 36% | 19% | $2,161 m |

| 2019 | 43% | 38% | 18% | $2,015 m |

| Source: Rollins Annual Reports | ||||

At first sight their M&A spend in 2020 might appear much reduced, but once the Clark Pest Control acquisition in April 2019 is removed from the figures, the firm’s global M&A spend actually rose in 2020. The most significant international acquisition was Adams Pest Control in Australia in July 2020. This purchase solidified the company’s national presence in that country. On the franchising side of the business, their first location in Ghana, Africa, was set up in July 2020.

As to the future, Steven Leavitt, group president, explained: “We are actively engaged in the acquisition market globally and working with candidates that we feel fit our model and culture. While dealing with the effects of the global pandemic, we continue to engage in discovery and pursuit of quality organizations in attractive markets.”

| 2020 Rentokil Pest Control Regional Revenue | ||

|---|---|---|

2020 ($m USD) | % increase (decrease) over 2019 | |

| North America | 1,415 | 3.1 |

| Europe (inc. Latin America) | 392 | (0.4) |

| UK and rest of world | 285 | (5) |

| Asia | 226 | (0.5) |

| Pacific | 113 | (1.3) |

| Ongoing operations | 2,435 | 1 |

| Source: Rentokil Annual Report 2020 | ||

RENTOKIL #1 GLOBALLY. While Rollins remains atop this year’s PCT Top 100, Rentokil (third on the Top 100) retained its No. 1 global ranking. In the company’s 2020 final results presented in its annual report, ongoing revenue increased 6.3 percent to $3,955 million (£2,846 million) and ongoing operating profit increased 5.4 percent to $539 million (£388 million).

With the onset of the global pandemic, Rentokil took swift action to reduce costs, conserve cash and boost liquidity, as well as suspend all M&A activity. However, in total, 21 pest control business were bought in 2020, the majority in a rush of activity in Q4. In the U.S., eight large regional firms were purchased, followed by the announcement early in January 2021 of the acquisition of Florida-based Environmental Pest Services — a company that ranked #15 on last year’s PCT Top 100. In this year’s Top 100 listing, Rentokil predicts a 21 percent increase in revenue.

Summing up his firm’s M&A activities, Andy Ransom, chief executive, said: “Well, after a very quiet period in Q2, when really everyone hit the pause button for M&A, the year ended with quite a flurry of deals, particularly in the U.S. That high level of M&A activity looks set to continue into the first part of 2021. So, rather than evolving, I would say it has largely picked up where it left off at the end of Q1. So I think M&A is alive and well and we have a very strong pipeline of opportunities at Rentokil Initial as we go forward into 2021.”

In the Rentokil annual report Ransom predicts an M&A spend of £400 million ($555 million) in 2021, but should the right assets come about, $1 billion in deals wouldn’t be out of the question.

TERMINIX CHANGES DIRECTION. In 2019 Terminix recorded an unprecedented level of M&A spend — in fact, the firm was the largest of the “big four” with notable acquisitions Nomor Holding in Sweden and part of Mitie Pest Control from Rentokil in the UK. However, this came to an abrupt halt late in 2019 when ServiceMaster announced the intended sale of all its franchise ServiceMaster brands. This was achieved in September 2020. With the completion of the sale, the company changed its name to Terminix Global Holdings, which allowed the firm to capitalize on the powerful Terminix brand name.

As for the future of M&A activity, recently appointed to the role, Christie Grumbos, senior vice president, M&A and business development, said: “COVID-19 really drove a significant slowdown across the industry, but the overall market is getting back to normal — and multiples are getting back to pre-COVID levels. We still managed to complete about 10 acquisitions in 2020 and a few so far in 2021. We are still actively looking, but are focusing on smaller tuck-ins right now.

“We didn’t see much of a slowdown, if any, in these kinds of acquisitions — as far as COVID is concerned. We have the ability to acquire a larger company, but it would really have to be the right strategic fit for our business. Our international M&A strategy is similar to our domestic strategy where we are primarily focused on deals that can add density and scale to our existing footprints in the UK and Scandinavia primarily,” said Grumbos.

STEADY GROWTH. Based in Stockholm, Sweden, Anticimex has steadily been growing its global presence. Although retaining its #8 spot on the PCT Top 100, the company’s sales revenue increased 26 percent in the U.S. Acquisitions ceased with the outbreak of COVID, but restarted in August and have continued strong into 2021. Internationally, the company entered the Cambodian market via the strategic acquisition of Antitermite, the market leader for pest control, and several purchases in France saw the company rise to one of that country’s top 10. Globally, the company had an estimated total M&A spend in 2020 of $247 million.

CEO and President Jarl Dahlfors views the pest control industry as a resilient business, which can only be viewed as good news as Anticimex is imminently aiming to take the business public on the Stockholm stock market.

The Anticimex business model remains the same, he says: “We stick to our three core principles: strong decentralized and entrepreneurial branches; the increasing use of SMART digitally connected technology; and a robust M&A program.”

DON’T OVERLOOK CERTUS. Although not a “big four,” the acquisitions program of private-equity funded Certus is making waves. Only launched in May 2019, its M&A spend has risen from $15 million in 2019 to $77 million in 2020, meaning the number and value of the acquisitions has propelled the firm up the Top 100 from #75 in 2020 to #23 this year, with a declared longer-term target of a top 10 ranking.

Regarding M&A activity, Certus CEO Mike Givlin said, “At Certus, we’ve been able to exceed our acquisition growth targets from the beginning. How have we seen this success in such an uncertain time? Simply put, we think there’s a better way to approach consolidation. We have the flexibility to personalize each offer and address what’s most important to the owners, from our commitment to doing right by their people to allowing them to quickly move on to their next adventure. Building that trust in our pest control community is key and referrals are our best source of new acquisitions.”

WHAT’S NEXT? A final word from Potomac’s Paul Giannamore: “Scarcity among quality assets, increased competition among buyers, tax increases on the horizon and yield-seeking speculative behavior in the public equity markets means that 2021 is shaping up to be the largest M&A year ever, not only in pest, but across all industries in the U.S.”

So — if you are reading this and contemplating selling, perhaps there has never been a better time. There are buyers afoot. Once sold, what you do with all the cash remains another issue — but as they say, “That’s another story!”

Note: Rentokil figures were converted with an exchange rate of £1 = USD 1.39.

Explore the May 2021 Issue

Check out more from this issue and find your next story to read.

Latest from Pest Control Technology

- SiteOne Hosts 2024 Women in Green Industry Conference

- Veseris Celebrates Grand Reopening of the Miami ProCenter

- Rollins' 2024 Second Quarters Revenues up 8.7 Percent YOY

- Fleetio Go Fleet Maintenance App Now Available in Spanish

- German Cockroach Control Mythbusting

- Total Pest Control Acquires Target Pest Control

- NPMA Workforce Development Shares Hiring Updates

- Certus Acquires Jarrod's Pest Control